(click on photo for the video of this scene)

(click on photo for the video of this scene)

This is part of my Series' on Venture Capital and Entrepreneurial Culture.

Over the years it’s been real privilege for me to mentor friends and acquaintances of mine who at one point or another in their careers have decided to make the leap into the start-up game. I happened to have had the particular advantage of starting early and so carry with me the proverbial scars on my back and psychic black-and-blue marks so reminiscent of the trade. It’s these same lumps that I always hope to help first-time entrepreneurs avoid.

Perhaps the most valuable counsel I can ever give to someone occurs right around the time they begin to raise capital to fund their company. This may well be the most vulnerable point of all in the life-cycle of a start-up for many reasons. One wrong move can literally mean the difference between success and a world of pain. Here’s truly where lack of experience, even in the smartest of people, can mean sheer disaster. I’ll start with the most important rule of all:

You need to know who you are dealing with.

Through no fault of their own, first time entrepreneurs fresh out of school, an academic lab or who have worked for years at big companies generally have no concept of the cast of characters that populate the early-stage ecosystem. If you have just emerged from this sort of cocoon, you no longer enjoy the invisible “protection” your old position or firm’s name provided and hardly realize how vulnerable you are. Essentially, you’ve arrived at a sort of Masked Ball, eyes wide shut, with no concept of who is around you.

Inevitably you will run into certain masked characters that may appear in any number of guises. Their firm might have the words “Capital” or “Ventures” in it, or they may say that they are part of a “group of investors”, and they will talk about the many startup companies they have “worked with”. Certainly they will discuss how much they would like to help you with your funding needs. But beware…

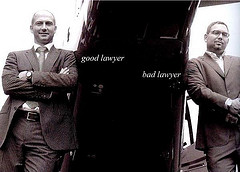

You may be in the midst of being initiated into the shadowy world of the “broker-dealer”, the “investment banker”, the “middle-man”. At some point you may well discover that he has no money to invest in your company whatsoever. Instead, he will want to “help you” raise capital for a fee, taking a percentage of the money raised for himself and perhaps a retainer and warrants to boot. It’s perfectly legal and I will say that there are indeed some reputable people operating in this business. But these are few and far between.

Jason Calcanis and Fred Wilson have recently published some posts, (here and here), describing yet another masked character on the scene- namely, the type of angel group that charges extremely hefty fees, (thousands of dollars), to entrepreneurs who wish to pitch them. This is definitely a character to avoid. Another type that needs to be vetted carefully is the one who tells you he's got a bunch of shell companies on the bulletin board stock exchanges and that with a flourish of his cape he can take your company public with a reverse merger. Warning bells should go off immediately.

The bottom line is that although there are some notable exceptions, most of these masked characters generally do not have your best interest in mind and I have both witnessed and been told of dozens of situations where unwitting entrepreneurs have been victimized by them. My advice is simple. If you are trying to raise capital for your start-up, ask around first, do your homework and talk to half a dozen or more entrepreneurs with funded startups about their experiences. Also, try to find a good mentor while you’re at it. In every community there are reputable angel investors, legitimate angel groups and of course a handful of early-stage venture firms that have money to invest if they like what they see.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=4a2ff167-e9ab-4776-abc3-9620246f6766)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=dcb7b315-8188-44ab-a214-ece71e73f947)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=f19e7f17-3b95-4642-aefa-a9d33403233c)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=a20cb29e-3e8f-444e-af50-2f31b291ecec)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=32984989-2bb2-48c2-b7bf-af9642d55d00)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=63a60ab3-e708-4123-83b3-60bbbd15e840)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=e0d938e5-b776-446a-a18b-d58564d82187)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=21b60f0b-3054-4f5f-9840-5283d1265196)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=c73e7729-f742-41de-ae53-2793ca169988)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=128cb0f9-5618-46e5-a05a-dd0d36c873ed)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=f3998b9c-2696-4d97-a595-02b0b916a315)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=be20dc8f-7988-41c9-a7e0-f6cc87f9ea23)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=2619fe9d-863c-463a-866a-81357651f3d9)